Mass Tax Calculator 2025 - Massachusetts Tax Rates 2022 & 2021 Internal Revenue Code Simplified 2022, Learn if you are required to make estimated tax payments to the mass. You are able to use our massachusetts state tax calculator to calculate your total tax costs in the tax year. Tax Calculator 2025 25 2025 Company Salaries, If you make $55,000 a year living in the region of massachusetts, usa, you will be taxed $11,915. Updated on feb 16 2025.

Massachusetts Tax Rates 2022 & 2021 Internal Revenue Code Simplified 2022, Learn if you are required to make estimated tax payments to the mass. You are able to use our massachusetts state tax calculator to calculate your total tax costs in the tax year.

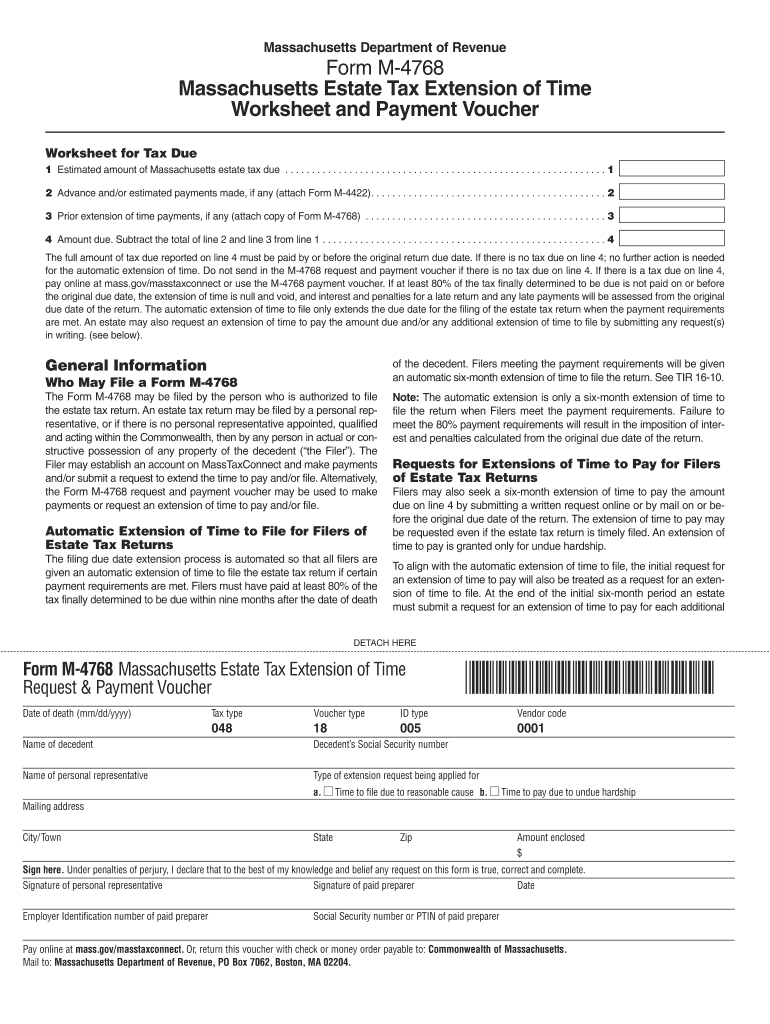

Tax estimated Fill out & sign online DocHub, Use a free paycheck calculator to gain insights. You are able to use our massachusetts state tax calculator to calculate your total tax costs in the tax year.

Ma tax calculator 2025 | massachusetts tax calculator.

Mass Tax Calculator 2025. Massachusetts has a progressive state income tax system that ranges from 5% to 9%. That goes for both earned income (wages, salary, commissions) and unearned income.

20252025 Tax Calculator Teena Genvieve, You are able to use our massachusetts state tax calculator to calculate your total tax costs in the tax year. Learn if you are required to make estimated tax payments to the mass.

This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional.

Tax Calculator Estimate Your Refund in Seconds for Free, Massachusetts' 2025 income tax ranges from 5% to 9%. Learn if you are required to make estimated tax payments to the mass.

![Massachusetts Capital Gains Tax [2025] Pavel Buys Houses](https://cdn.carrot.com/uploads/sites/36702/2021/09/capital-gains-tax-selling-home.png)

Tax rates for the 2025 year of assessment Just One Lap, The massachusetts state tax calculator (mas tax calculator) uses the latest federal tax tables and state tax tables. Massachusetts' 2025 income tax ranges from 5% to 9%.

Massachusetts Capital Gains Tax [2025] Pavel Buys Houses, Income, fiduciary, corporate excise, and financial. Learn if you are required to make estimated tax payments to the mass.

Massachusetts has a progressive state income tax system that ranges from 5% to 9%. Ma tax calculator 2025 | massachusetts tax calculator.

Massachusetts Tax Calculator 2025 2025, Just enter the wages, tax withholdings and other. Income, fiduciary, corporate excise, and financial.

Massachusetts DOR tax calculator Internal Revenue Code Simplified, Ma tax calculator 2025 | massachusetts tax calculator. Use a free paycheck calculator to gain insights.

Your Guide to Navigating the Massachusetts State Estate Tax Law, This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional. Free tool to calculate your hourly and salary income after taxes, deductions and exemptions.